Trade with Support and Resistance Trading with Smart Money

Contents:

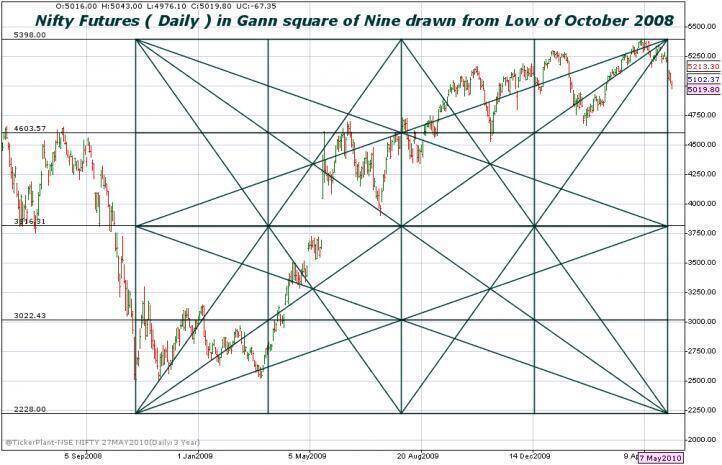

Similar to trendlines, channels can also be used to identify support and resistance levels. A channel provides both support and resistance for the price by its lower channel line and upper channel line, respectively. The following chart shows a support and resistance chart based on a rising channel. Round-number support and resistance levels are horizontal lines drawn at round-number exchange rates, such as 1.00, 1.10, 1.20, 1.25 etc.

The resistance point just broken is the new support point in the next trading range. Support and Resistance levels are critical tools in a trader’s belt. It’s where a lot of crypto signals and trading happens and they tend to be simple trading setups with high win rates. You can find trade setups for support and resistance levels on altFINS’ platform. Once an area of support or resistance has been identified, those price levels can serve as potential entry or exit points.

A support level is a price a stock tends to stay above. When the buyers gain the upper hand, the bottom of the pullback is a support level. For both shorts and longs, support and resistance are day trading basics. Knowing how to determine them is fundamental to the trading patterns I use.

In the chart below, we see an example of support and resistance levels containing price within a trading range. A trading range is simply an area of price contained between parallel support and resistance levels like we see below . Technical analysis focuses on market action — specifically, volume and price. Technical analysis is only one approach to analyzing stocks.

Types of Support and Resistance

And you miss the trade because you were waiting for the market to test your exact SR level. Higher lows into Resistance usually result in a breakout . Lower highs into Support usually result in a breakdown . When the price passes through resistance, that resistance could potentially become support. Looking at the chart now, you can visually see and come to the conclusion that the support was not actually broken; it is still very much intact and now even stronger.

While there is no exact science to establish support and resistance levels, it is essential to understand what they mean, how they work, and most importantly, how to use them. Uncovering support and resistance levels patterns and plotting them on your own may be difficult, but if used properly, they can help you set up more profitable trades. It’s common practice to place pending orders ahead of support and resistance levels and then just wait for the price to get there, hoping to see a bounce or a break. Again, support and resistance levels just show potential, and it’s usually impossible to make predictions about whether a level will hold or break. For that reason alone, it’s important to keep updating your support and resistance levels. We recommend going over all your levels at least once per week and check whether the markets are still paying attention to the levels on your charts.

EUR/USD: The difference between the levels of interest rates in the US and the Eurozone is narrowing

In fact both Manual stophttps://traderoom.info/ and trainling stoploss are manual….they are two different technique of placing SL. For example if you buy a stock at 100 and you are willing to lose Rs.5 on it, then your manual SL is Rs.5. Sir, I have read almost all the chapters and its really useful. Can you plz tell how to use trailing stop loss, should it be based on any indicator or manual stop loss.

BTC Faces Risk of Sub-$28000 on Hawkish Fed Chat and US Stats – Nasdaq

BTC Faces Risk of Sub-$28000 on Hawkish Fed Chat and US Stats.

Posted: Thu, 20 Apr 2023 01:03:00 GMT [source]

In the previous situation, because prices advanced, the combined reaction of the market participants caused each downside reaction to be met with additional buying . However, if prices start to drop and move below the previous support zone, the reaction becomes just the opposite. All those who bought in the support zone now realize that they made a mistake. Now… let’s learn a Support and Resistance trading strategy to profit from breakout traders.

While analyzing any coin, traders must look for support and resistance levels as they can act as good entry and exit opportunities. As a result, traders anticipate that those levels could again form an obstacle for the price in the future. Support and resistance charts work great in all financial markets. There is no hard rule on how far back support and resistance levels should be drawn. Younger support and resistance levels are usually more important than older ones, as they represent a fresh price-level where the market had difficulties to break above or below.

Say a stock that’s running for several days finally reaches a parabolic stage with massive volume. Traders chase it at these high prices, hoping for an easy trade. But a parabolic move isn’t a good long opportunity — it’s bound to become overextended. Even after it’s clear a stock has found support, less-experienced traders might chase it even higher.

Trading supports in an uptrend

At this point though, we are still unsure if a large trading range will develop. The subsequent low in December, which was just higher than the October low, offers evidence that a trading range is forming, and we are ready to set the support zone. As long as the stock trades within the boundaries set by the support and resistance zone, we will consider the trading range to be valid. Support may be looked upon as an opportunity to buy, and resistance as an opportunity to sell. Major support and resistance areas are price levels that have recently caused a trend reversal.

All about range-bound markets in crypto and common strategies to trade them – CNBCTV18

All about range-bound markets in crypto and common strategies to trade them.

Posted: Mon, 17 Apr 2023 16:23:30 GMT [source]

There are many more trading concepts to learn like price actions, risk management, and trading psychology. You also need to learn various confirmatory strategies to combine with support and resistance before entering into a trade. Round numbers usually serve as resistance and support because prices find it hard to go past them. They are sometimes referred to as psychological support and resistance zones because they do not necessarily correlate with any technical pattern on the chart—they are in our minds. Price usually respects support and resistance levels until it breaks them. Traditionally, support and resistance levels are indicated with lines, even though those levels are not precise in real-life situations.

Support and Resistance Levels Don’t Always Hold.

The price of financial assets is determined by forces of demand and supply, just like in any other trading market. In financial markets, it is support and resistance levels that accurately illustrate how the supply and demand forces interact to determine the prevailing price of an underlying asset. Prices usually rise until the supply outstrips demand and that is the point of resistance, where prices will start going down. Similarly, prices will fall until demand outstrips supply and that is the point of support, where prices will start going up. After Lucent declined, a trading range was established between 40.5 and 47.5 for almost two months .

Day trading guide for today: 6 stocks to buy or sell on Thursday — 20th April Mint – Mint

Day trading guide for today: 6 stocks to buy or sell on Thursday — 20th April Mint.

Posted: Thu, 20 Apr 2023 00:32:39 GMT [source]

In short, demand overwhelms supply, bidding prices higher, causing a price decline to halt, or reverse and move higher. If the stock market drops to that area again in the future, $220 could potentially act as support. If it breaks through the support level, traders will probably see it as weakness and sell, driving the price even lower. Identifying support and resistance alone does not guarantee success in trading.

The moving average periods shown on the cheat sheet were popular with floor traders back in the day. If you are new to trading and do not know how to correctly draw horizontal support and resistance levels, always round up to the next Big Round Number. A confirmation is necessary because not all support or resistance holds. It is better to confirm if the odds are in our favor before entering any position. It would be challenging to form any profitable trading strategy without knowing how support and resistance work.

How to find Support and Resistance in crypto?

I ask this because on your book you seem to only mention a Daily time frame. Your lessons are very easy to understand for those who’re keen learner and consider having financial freedom. Though I’m new to forex and I have decided to go into trading.

- There’s no ‘best’ time frame for finding support and resistance levels.

- Waiting for one means that good trading opportunities could be missed.

- Pivot points are mathematical computation levels based on the previous day’s high, low, and closing prices.

- Neither form of analysis is fool-proof, so taking profits when you have them is always a good thing to do.

The more times the price level has stopped previous advances or supported previous declines, the strong will be the resistance or support in the future. If another resistance zone exists above the one that was just broken, prices will typically trade up to that next higher zone. Thus, a resistance zone in an advancing market can become a price objective once a lower resistance zone is broken.

Some of these signals, such as Fibonacci Retracements, have a fixed bullish or bearish interpretation. Others, such as crossovers of a short-term and a long-term moving average, are interpreted as a reversal of the current signal. The complete Cheat Sheet can be used to give an indication of market timing. TheTrader’s Cheat Sheetis a list of 44 commonly used technical indicators with the price projection for the next trading day that will cause each of the signals to be triggered. It’s the level at which the buyers come in and start buying a stock, because they believe that the price won’t go lower than that level. So, if the stock price drops to the support level, it’s like the buyers have put a floor on the price and won’t let it go lower.

For example, a $5 support level may experience a sell-off to $4.90 before bouncing back up the support. Therefore, it’s important to be aware of how much wiggle room to give for any specific stock you trade. In a downtrend, a trendline is drawn from one particular high, connecting subsequent lower highs and projecting the line into the future.

PeopleSoft found support at 18 from Oct-98 to Jan-99 , but broke below support in Mar-99 as the bears overpowered the bulls. When the stock rebounded , there was still overhead supply at 18 and resistance was met from Jun-99 to Oct-99. Support can be established with the previous reaction lows, while resistance can be established by using the previous reaction highs. Support turned into resistance or resistance turned into support.

- Signal Strength is a long-term measurement of the historical strength of the Signal, while Signal Direction is a short-term (3-Day) measurement of the movement of the Signal.

- On the other hand, the bears stop selling because they believe the market has fallen enough and may be due for a rebound.

- Because of the chasers, these levels can stop a stock from going higher.

- They’ve changed their sentiment from sellers to buyers.

Consequently, it resumed the buy support sell resistance and reversed near the 261.8% Fibonacci extension point, which is based on the High, Low and Retracement levels of the initial bullish swing. Even wondered why that shirt you bought had a price tag of $39.99 instead of $40.00? Marketing professionals have long exploited how we humans perceive prices and how charging a cent less can have an impact on your purchasing behavior. While marketers exploit human psychology by not offering round figure prices on products, in the Forex market, the traders do flock around big round numbers and place their orders. If you draw two parallel lines connecting the absolute highest and absolute lowest points, you get a frame of reference for your trade. Those are the possible levels you can and should be aiming to touch.

Barchart Opinions add market-timing information by calculating and interpreting signal strength and direction. Unique to Barchart.com, Opinions analyzes a stock or commodity using 13 popular analytics in short-, medium- and long-term periods. Results are interpreted as buy, sell or hold signals, each with numeric ratings and summarized with an overall percentage buy or sell rating.

Leave a Reply