Bitbuy Reviews Read Customer Service Reviews of bitbuy ca 2 of 13

Contents:

All consultations and conversations with Loans Canada and its partners are confidential and risk-free. Speak with a trusted specialist today and see how we can help you achieve your financial goals faster. Loans Canada and its partners will never ask you for an upfront fee, deposit or insurance payments on a loan.

Besides, its team has passed background and client information handling checks, meaning it runs a highly competent service. The only issue may be an SMS-based 2FA user account security system, which was proven to be insecure in the past. Bitbuy is known to be a user-oriented platform that makes buying top cryptocurrencies easy, fast, and convenient. Instead of being a one-stop-shop for all sorts of crypto-related services, it focuses on building trust by being user-friendly, regulatory compliant, and focused cryptocurrency exchange. The downsides are its new, higher trading fees and the lengthy verification process.

Bitbuy is a Canadian cryptocurrency exchange platform that was founded by Adam Goldmanin Toronto, Canada, back in 2013. The platform is suitable for Canadian citizens only and is considered to be one of the most popular and leading crypto exchange platforms in the country. If you’re a Canadian crypto enthusiast, you have access to multiple cryptocurrency exchange platforms, both international and local ones. However, when choosing a platform, there are multiple factors that come into play. Today, we’ll focus on Bitbuy review and evaluate the platform based on all the aspects that matter the most. Bitbuy is a Canadian cryptocurrency exchange founded in Toronto in 2016.

Corporate accounts

The company’s codebase is privately maintained, meaning your intellectual property is safe from external eyes. 2 factor authentication , which should without question be used on almost anything you sign up for these days, is a mandatory requirement at Bitbuy. Security is paramount when we are investing, more so with cryptocurrencies. In fact, crypto fraud cost people more than $1.2 billion in 2019 alone.

- The main company’s goal was and still is to provide easy and secure access to Bitcoin and other popular cryptocurrencies.

- Although it’s designed for smaller screens, it’s as feature-rich as the desktop version and lets you trade cryptos with the push of a button.

- However, Bitbuy wanted to expand their offering dramatically and accepted an investment from a private equity firm in 2018.

- Therefore, users with zero crypto knowledge also can easily use Bitbuy.

- Then select a withdrawal method, enter the amount and enter the name of the bank.

If this happens to you, you can contact the support team to get it resolved. When trading with Bitbuy, it’s best not to do anything unusual for your account. Bitbuy may be the perfect digital trading platform for your personal and financial needs.

The online reputation is strong across all boards, some regard it as the number one Canadian cryptocurrency exchange. It makes for happy reading, these places are usually breeding grounds for disgruntled users. Bitbuy’s customer service is one of the best in the cryptocurrency industry. The first notable https://broker-review.org/ element is a customer support phone line which is usually a scarcity. Adding to this, email support is quick and responsive, replying to queries in under 12 hours, even on a weekend. Although if you would like to make a larger transaction the Bitbuy OTC desk is happy to help you personally.

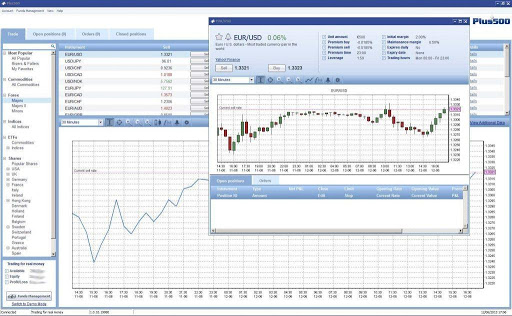

They appear to be a relatively safe exchange and their fees are broadly in line with the rest of the market. While trading fees are slightly higher, their deposit and withdrawal fees make up for it. For the more advanced traders out there, you will probably want to trade on Bitbuy’s more advanced trading platform. This is more like your typical exchange with customer order books matched with an exchange “matching engine”. Bitbuy is now also available on-the-go with their mobile app, which is available for both iOS and Android devices.

List of Canadian CDRs – Canadian Depository Receipts for US Investing

I found the app extremely easy to use, and the interface allowed you to deposit, withdraw or purchase cryptocurrency all with a few clicks. And finally, Bitbuy uses a “KYC” model, which is short for Know Your Customer. This verification process, primarily done through the exchange of documents proving your identity, is one of the main ways the company prevents things like crypto related fraud. For the experienced traders, Bitbuy has a Pro Trade feature that displays much more information than the Express Trade option.

Compare dozens of Canadian crypto exchange platforms and find the one that best suits your needs. Users need a Canadian mobile number to register and trade. Bitbuy exclusively provides services to Canadian citizens. Platforms like Coinbase and Binance have an international presence while also catering to Canadian customers.

Purchase a Bitcoin or Ethereum exchange-traded fund from your investment account. Get the best cryptocurrency rates with your very own personal Account Manager. We provide the best prices and transparent fee structure. Our Bitbuy review was relatively straight forward and it seems as if this exchange “does what it says on the tin”.

They also asked me to confirm my bitcoin wallet, which I had already done in my initial withdrawal request. However they no longer answer support tickets and my funds can’t be withdrawn as their system has my previous transaction marked incorrectly which stops me from being able to withdraw. Most Interac e-Transfers will settle within the same day, bitbuy canada review and, in some cases, several hours. NDAX is also a good option which offers crypto staking for five cryptocurrencies. Bitbuy has slightly more “excellent” reviews on Trustpilot than “bad” reviews, so most customers are happy with Bitbuy. Reached out using the support email with a general question and received a personalized response instantly.

Over 1,500 businesses have already entrusted their crypto dealings to this company. Pro Trade is Bitbuy’s advanced trading mode and a tool you’ll most likely switch to when you learn the crypto trading ropes. You simply select whether you’re buying or selling, choose the cryptocurrency you’re interested in trading with from the drop-down menu, and enter the amount. As the name suggests, Express Trade is Bitbuy’s no-frills, instant trade mode.

Why do traders use Bitbuy exchange?

While standard fees are comparable, Bitbuy Pro users get access to some of the most competitive fees on the market. The number of cryptocurrency trading options available is somewhat limited, with Bitbuy sticking to the most popular coins, but their selection should suffice for the average crypto trader. Buying and selling cryptocurrencies used to be complicated, not to mention shady. Nowadays, there are dedicated crypto exchanges and platforms where you can quickly – and safely! – trade all the popular crypto coins, or even stake them and earn more over time. BitDegree Crypto Reviews aim to research, uncover & simplify everything about the latest crypto services.

Signing up to Bitbuy is quite a long process due to their compliance process. Next, provide your identity details, including your real name, date of birth, and occupation, then click on the button. Alternatively, you can access the button within your account after logging in.

Bitbuy mobile platform review

Bitbuy’s customer service reputation is excellent, with a consistently quick response time and knowledgeable staff. While the clean and simple user interface means new traders can cut their teeth with trading crypto, Bitbuy Pro is available for more experienced traders. Bitbuy can accommodate large transactions with Bitbuy Corporate and their OTC trading desk. Bitget is a reliable crypto exchange that operates globally in many different countries. It offers a web interface and the Bitget app to enable users to trade and invest in 500+ cryptocurrencies. Yes, Bitbuy is a federally regulated company that’s registered as a Money Service Business with the Financial Transactions and Reports Analysis Center of Canada .

Bitbuy says that they operate a policy of 95% cold storage of coins. This is the standard among cryptocurrency exchanges and protects the bulk of user’s assets from hackers. Bitbuy is suitable for both beginners and experienced traders. The Express platform offers a simple, easy-to-use interface where you can buy crypto in minutes. If all you’re looking for is a quick purchase at market price, then Bibuy Express is the way to go.

What Services does Bitbuy offer?

Also, transactions are quick, but the fees can be slightly higher when compared to the Pro Trade option. To use this platform you will need to have a North American phone number as well as provide an address in Canada. If you’re looking for a reliable cryptocurrency exchange that’s available internationally, you should consider Coinbase, Binance and Coinmama. Before finishing this Bitbuy review, there’s a final thing to remember. If you take your security seriously and are thinking about buying cryptocurrencies, always make sure to also get a secure wallet for your assets. In case you don’t know where to start, check out Ledger Nano X and Trezor Model T first.

For example, anyone looking to buy a cryptocurrency simply needs to select the crypto they’d like to buy, the amount they want and then confirm their order. It’s available through the Google Play Store and the Apple App Store. Although it’s designed for smaller screens, it’s as feature-rich as the desktop version and lets you trade cryptos with the push of a button. Most people trade crypto on the go, so we were glad to find there’s an official – and completely free – Bitbuy app for both Android and iOS devices. You’ll then need to provide a valid email address, which you’ll need to verify afterwards, and create a secure password.