PERSONAL TAX & BOOKKEEPING SERVICES 4551 S Westmoreland Rd, Dallas, Texas Tax Services Phone Number

Content

The bookkeepers at Perfect Balance have QuickBooks ProAdvisor certification and can help transition your business to QuickBooks for easier, more accurate processing. Because there is sure to be a learning curve, you can receive training and guidance when making the switch, in addition to ongoing advisement and QuickBooks training for your employees. Outsourcing to professional bookkeepers can help you keep company finances in order. This is a detailed list of the best bookkeeping services in Dallas.

- Perfect Balance can also determine if your company needs to pay estimated quarterly taxes.

- You can also find financial statements and job profitability reports on their menu to help guide your business decisions.

- You can count on the seamless transfer of data to our CPAs and tax professionals for income tax preparation and other financial reporting.

- The city tax chart provides the local code, the local rate, and the combined state-local sales tax rate.

- We’ll organize your accounting processes and generate the precise reporting needed to reveal a clearer picture of your finances.

More information on the ‘statsmodels’ X-13ARIMA-SEATS package can be found here. More information on X-13ARIMA-SEATS can be found here.Many series include both seasonally adjusted (SA) and not seasonally adjusted (NSA) data. Occasionally, updates to the data will not include sufficient seasonal factors to trigger a seasonal adjustment. In these cases, the NSA series will be updated normally; but the SA series will also be updated with the NSA data. We welcome new clients with a free initial consultation and offer all our services at affordable rates. Every service to save you money at tax time, with access to a CPA all year.

Federal Reserve Economic Data: Your trusted data source since 1991

Williams & J Bookkeeping is another good bookkeeper for small businesses. This accounting company specializes in helping self-employed workers and independent contractors. They offer off-business work hours and provide remote services to make it easier for business owners to receive the bookkeeping and tax help they need. Bookkeeping Services of Plano is an accounting firm located in Plano with well over 20 years of experience in the industry. Bookkeeping Services of Plano is an Intuit QuickBooks Certified ProAdvisor and a Better Business Bureau accredited business with an A+ rating.

- Avoid the panic that arises when faced with a year’s worth of receipts and invoices that haven’t been recorded and returns are past due.

- By offering a combination of bookkeeping and tax services in Dallas, Shariff CPA covers all angles covered.

- Williams & J Bookkeeping also provides tax processing services starting at $275 for W-2 filers.

- While an employee is less likely to give it to you straight, an independent bookkeeping team will tell you exactly what they see.

- Moses Bookkeeping & Tax Service also offers a free consultation.

Our end goal is to provide a service that utilizes current technologies and advantages of a digital world to make your experience as complete as possible. We have the team to help manage the finances, so you can focus on growing your business. Xendoo’s online tools work with your platforms to give you up-to-date financial reports when you need them. For anyone hoping to start a business, the Business Creation package will help you structure your organization for the most appropriate tax strategy possible. Representatives from R&R will also guide you through the setup process and help file your paperwork for a successful launch.

Price: Contact us to get your free small business bookkeeping assessment

The company’s owner and principal accountant, Stephanie Matlock, began her accounting career at the impressive age of 16 years old. The agency offers bookkeeping, small business services, and individual tax preparation. The company’s goal is to educate, empower and help their clients succeed.

How much is tax in Dallas Texas?

The 8.25% sales tax rate in Dallas consists of 6.25% Texas state sales tax, 1% Dallas tax and 1% Special tax. There is no applicable county tax. You can print a 8.25% sales tax table here. For tax rates in other cities, see Texas sales taxes by city and county.

Our bookkeepers produce financial documents and other statements in addition to preparing deposits and checking receipts. Our bookkeeping process can handle staff payroll, invoices, purchases and keep track of all accounts. It is important that all bookkeeping bookkeeping dallas documentation is done in a timely manner without errors. If you don’t handle your tax appropriately, you can end up losing several bucks. But you don’t have to worry about that, as eBetterBooks has brought you an accurate and full-fledged tax report.

Kelly CPA

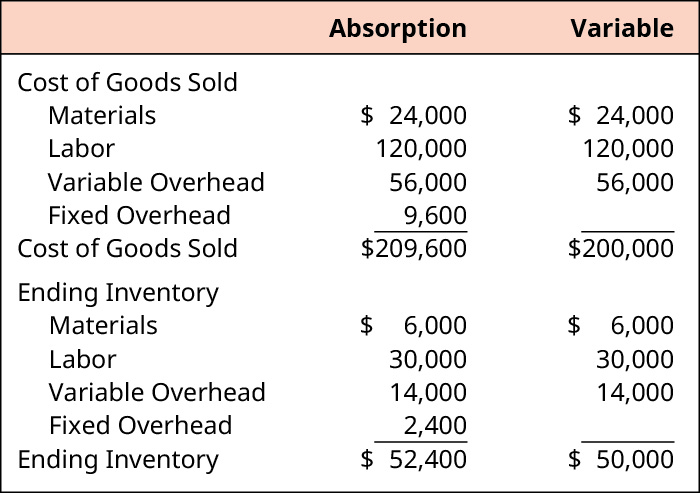

You can set a new course and know that we will keep your books on an even keel, despite any turbulence your business may be dealing with. To achieve a true financial picture of your company’s health, you need to pick the best bookkeeping methods. Accrual shows money in the month it was earned, not necessarily paid. Cash is more straightforward, showing when the payment arrived instead of when the debt occurred. Companies that offer employee benefit plans like health insurance or retirement benefits are governed by the Employee Retirement Income Security Act of 1974 (ERISA).

Get small business financial solutions with a hometown human touch. We are bookkeepers passionate about keeping your books so pristine that you could eat off them. Our team has access to the best bookkeeping software, providing you with the benefits of good software without incurring unnecessary costs. Bureau of Labor Statistics, the average pay for an in-house position is over $40,000 for someone starting out in bookkeeping.

Our goal is to do the math and to report to you accurately without bias or agenda. Financial statements and other financial accounting documentation helps you know what’s happening in real time even as you plan the future of your business. Having an accurate knowledge of your business finances is essential. Whether you want to find someone online or you are looking for local bookkeepers, Slaton Financial Services has you covered.

Ron Allen is a former IRS agent and a certified public accountant offering detailed professional bookkeeping services in Dallas. Accounting services include management of your company’s general ledger and financial reporting, as well as regular bookkeeping and corporate tax preparation. Solutions Tax & Bookkeeping, LLC is a tax and bookkeeping firm located in Frisco.

Continue building your business. We’ll handle the accounting.

We’ll organize your accounting processes and generate the precise reporting needed to reveal a clearer picture of your finances. With our assistance, you’ll more easily monitor cash flow, track expenses, and manage your money with efficiency. We’ll also devise a tax strategy aimed at reducing liabilities and directing more revenue towards your bottom line. EBetterBooks offers a variety of pricing choices based on the size of your business. Each package includes common bookkeeping services, profit and loss reporting, and other data.

- With an accurate value each month, you can get a better insight into your business.

- Concerning finances, a small- to medium-sized firm often needs three-level assistance.

- Xendoo’s online tools work with your platforms to give you up-to-date financial reports when you need them.

- This comprehensive experience makes Gurian CPA Firm stand out among Dallas bookkeeping companies.

- EBetterBooks offer an accurate profit and loss statement every month.